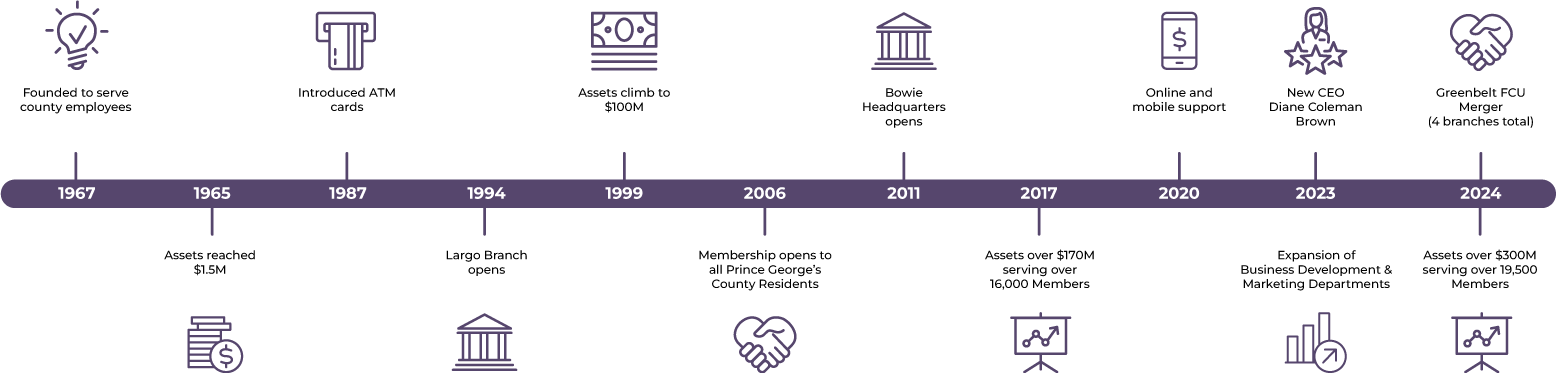

Our Story

Established in 1967, Prince George’s Community Federal Credit Union was founded to provide financial services to employees of Prince George’s County. Over the decades, we’ve grown to proudly serve more than 19,500 members across the county. With assets exceeding $300 million, our community-focused credit union welcomes individuals who live, work, volunteer, worship, own a business, or attend school in Prince George’s County to join. For more information about the organization or to become a member, please visit www.PrinceGeorgesCFCU.org or call 301.627.2666.

Our Mission

Providing exceptional service with integrity.

Our Vision

Help our community achieve financial success.

What drives you? We are here to help.

Looking to create a nest egg, send kids to college, trek the globe on vacation, finance a business, or purchase a new home? Do it all with Prince George’s Community Federal Credit Union.

Open an Account Learn About Benefits

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

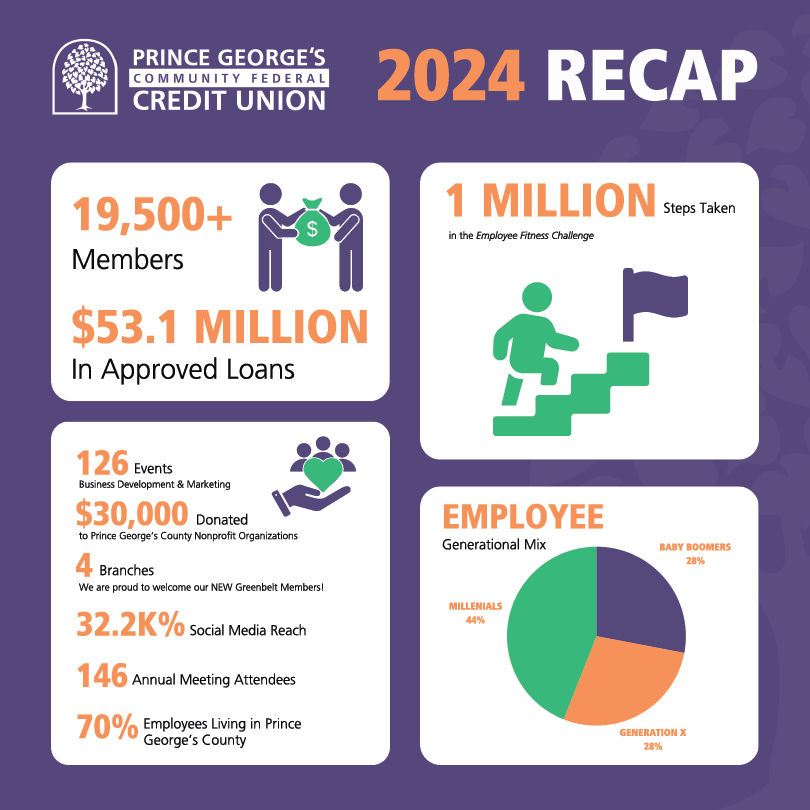

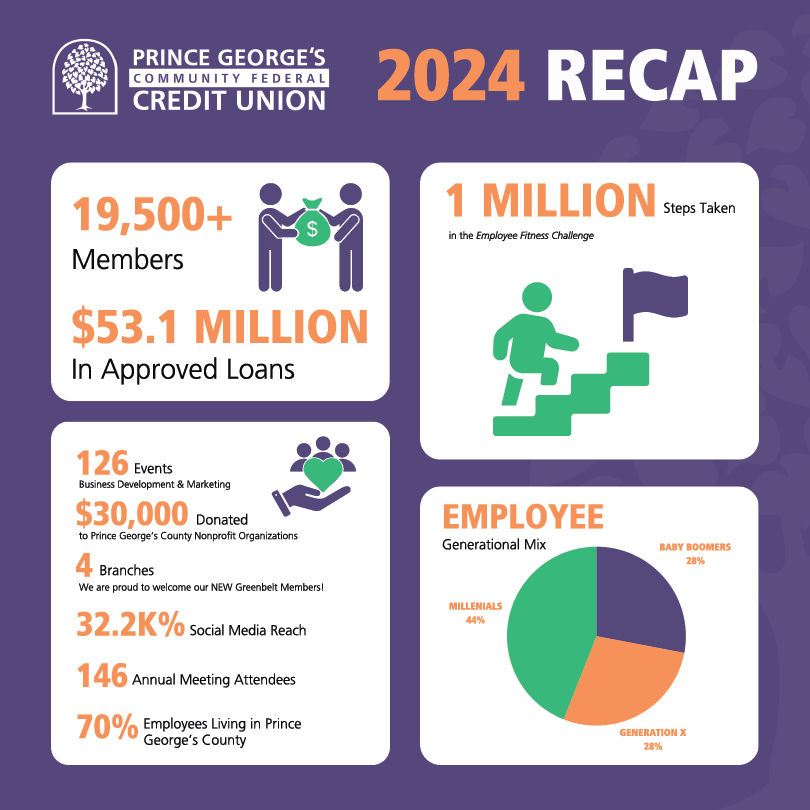

2024 PGCFCU Recap

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------